$AMC, $FBX, $GBTC

AMC Entertainment Holdings Inc. (AMC), FBX, Grayscale Bitcoin Trust (BTC) (GBTC)

Short sellers are supposed to borrow an asset that they believe will drop in price in order to buy them after they fall. If they’re right, they return the asset and keep the difference between the price when they initiated the short and the price when they buy the shares back to close out the short position.

Brokers and Crypto Exchanges do not actually do that, what they do is something called naked short selling, nowhere near as sexy as it sounds.

Naked short selling is short selling an asset without first borrowing the asset from someone else. It’s the practice of selling short that have not been affirmatively determined to exist. Per the U.S. Securities and Exchange Commission (SEC), naked short selling is illegal but it still happens, in the Crytpo world as we have seen with FTX and many other Exchanges it is extremely common. The naked shorting tactic is high risk but also poses a high reward.

- A short squeeze happens when many investors bet against an asset and its price shoots up instead.

- A short squeeze accelerates an assets price rise as short sellers bail out to cut their losses.

- Contrarian investors try to anticipate a short squeeze and buy an asset that demonstrate a strong short interest.

- Both short sellers and contrarians make risky moves. A wise investor has additional reasons for shorting or buying that asset.

Here are the short squeeze plays to benefit from now:

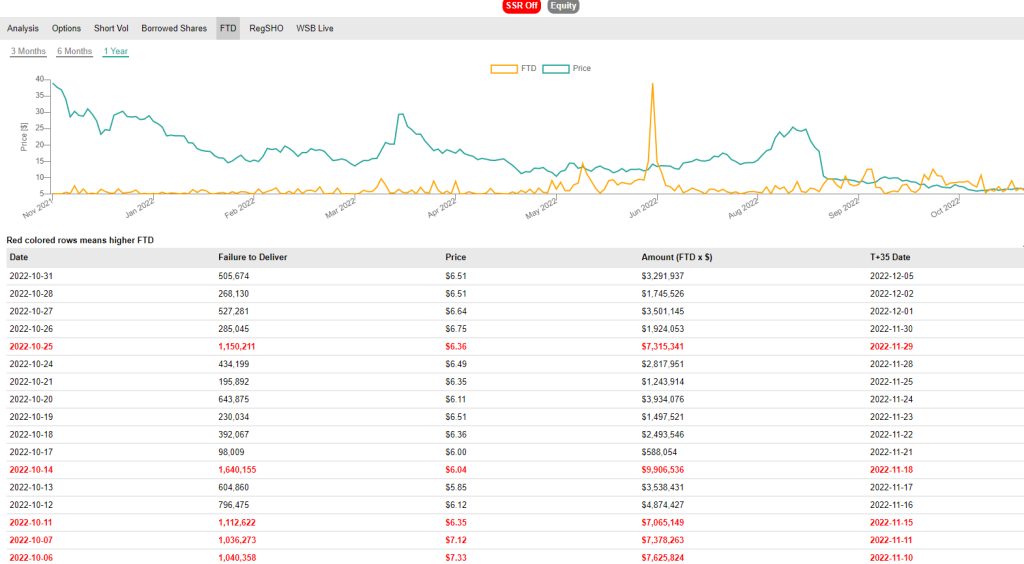

AMC

AMC Entertainment Holdings, Inc. (AMC) is back in the short squeeze zone!!

Exceptionally high short interest in AMC, the stock’s recent rally has pushed cost-to-borrow rates into the stratosphere and it is on the verge of another massive run.

FBX

This is a rare one FBX is over 99 owned by KXCO that have been running a buy back, there is a few million at the most left and the rest has been “imagined” by brokers and the sell orders are lined up.

With KXCO already announcing they plan to pull back tokens and having done so already this one is also on the brink of a break out.

FBX is in the top 10 of all Tokens according to CMC, Top 800 according to Nomics who give it an A rating and is also listed on Forbes.

https://www.mexc.com/exchange/FBX_USDT

Grayscale Bitcoin Trust (BTC) (GBTC)

We think the market overreacted to the Coward SBF.

Grayscale Bitcoin Trust (BTC) (GBTC) nothing gives us the impression the holdings are in doubt, Coinbase is safe and Bitcoin outlook is strong.

GBTC owns approximately 633,000 Bitcoin (BTC) held by its custodian, Coinbase (NASDAQ:COIN) Custody.