Crypto: Big Banks in, in Big Way

#crypto #banks #invest #talos #digital #assets #bitcoin $BK $C $WFC $BTCUSD The…

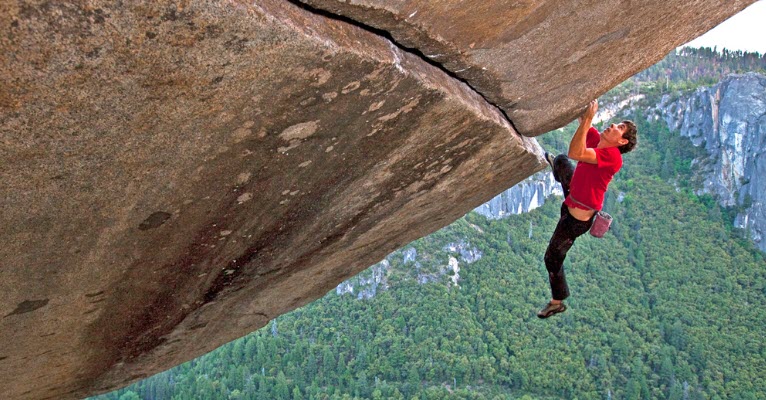

Investors Shake Off War Related Jitters and Climb the Wall of Worry

#markets #capital #stocks #bonds #cryptocurrencies #globalization #Russia #Ukraine #war #economy #inflation #knightsbridge…

Interest Rates are So Low that Cash and Bonds are “Stupid to Own”

#investments #portfolio #cash #bonds #interest #bitcoin #digital #assets #inflation #wealth #power "If…

Hedging Inflation Risk with ETFs

#inflation #CPI #hedging #risk #ETFs #stocks #bonds #growth #value #bitcoin #cryptocurrencies $GCC…

Crypto is Really Going Mainstream

#crypto #bonds #Coinbase #DeFi #blockchain $COIN $GS "Goldman Sachs managed the sale…

Stocks, Bonds, ETFs and Mutual Funds

#stocks #bonds #ETFs #mutualfunds "Think of investing as if you were building…

Investing in the Inflation Scenario

#inflation #investors #portfolio #money "For consumers, inflation can mean stretching a static…

Building an Investment Portfolio

#stocks #bonds #crypto #metals #investment #portfolio $SPY $SPX $RUT $QQQ $DIA "There…

The New Nominal is Pro-risk as the World Restarts

#stocks #bonds #inflation #China #risk "The US economy is seeing a very…

The USD’s Sensitivity to US Economic News, What is It?

#dollar #cryptocurrencies #bitcoin $USD $DXY $EUR $BTC $DIA $QQQ $SPY $RUTX $VXX…