Latest Metals News

Gold Miners a Buy $NEW $GOLD Zijin and Shandong

In an era marked by economic volatility, geopolitical tensions, and shifting market…

Protecting Wealth Amidst Looming Dollar Collapse $MSTR $RIOT $NEW $GOLD $KGC

As global economic landscapes evolve, a specter looms over the United States—…

Bitcoin and Gold are Your Life Rafts in a Sea of US Dollars

The world is awash in US dollars. Central banks are printing with…

Why Knightsbridge Sees Opportunity in U.S. Gold Miners $NEM $GOLD $FCX

In an era of economic uncertainty and volatile markets, gold often shines…

The Fed’s Early Rate Drop: A Boon for #Bitcoin and Gold $GOLD $BTC

In a strategic move to navigate the economic landscape, the Federal Reserve's…

Knightsbridge Recommendation: Invest in Gold and Gold Miners

Central Banks Continue Gold Buying Spree - Time to Follow Suit? Central…

Knightsbridge Predicts Gold Could Touch $5,000 in 2024

In a bold forecast, renowned financial advisory firm Knightsbridge has asserted that…

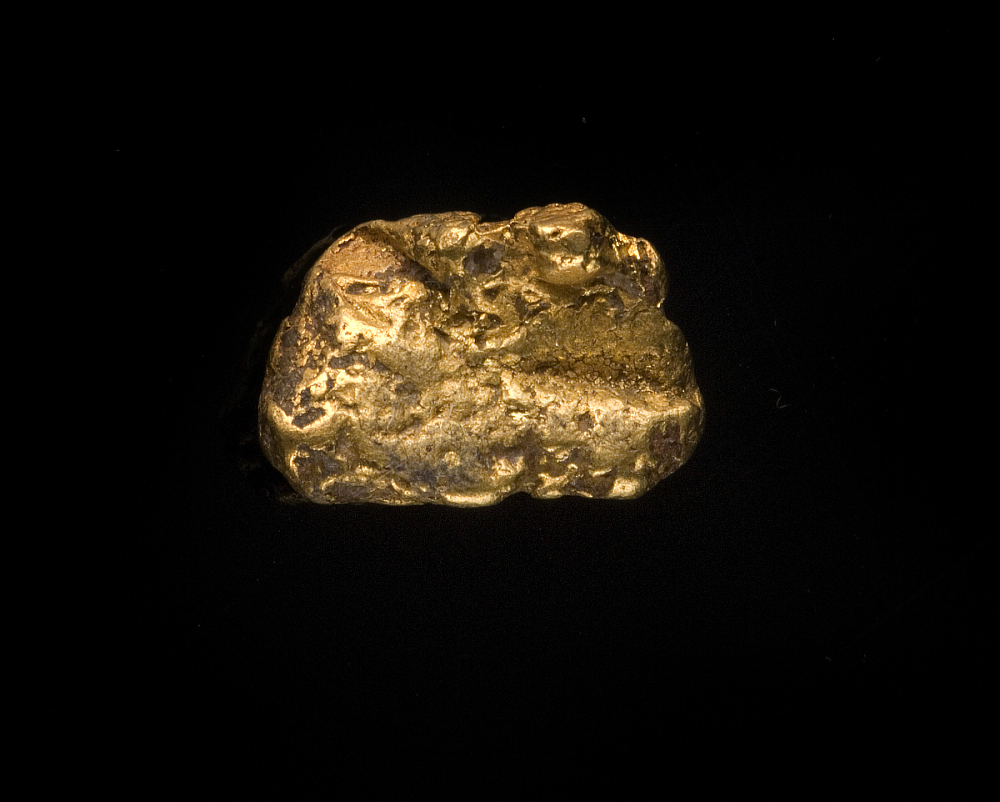

Why Gold Miners Outshine Gold Itself $GOLD $NEW $AU

Gold has long been regarded as a symbol of wealth and a…

Central Banks Buying Gold

Central banks gold buying maintained a historic pace but fell short of…

Gold and Silver are Buys

Despite the recent weakness in gold and silver prices, Knightsbridge believe that…