The US could be “The Inflation Nation” for Quite a While

#Fed #assets #liabilities #inflation #crypto #digital #gold #silver #dollar #bitcoin #ether $USD…

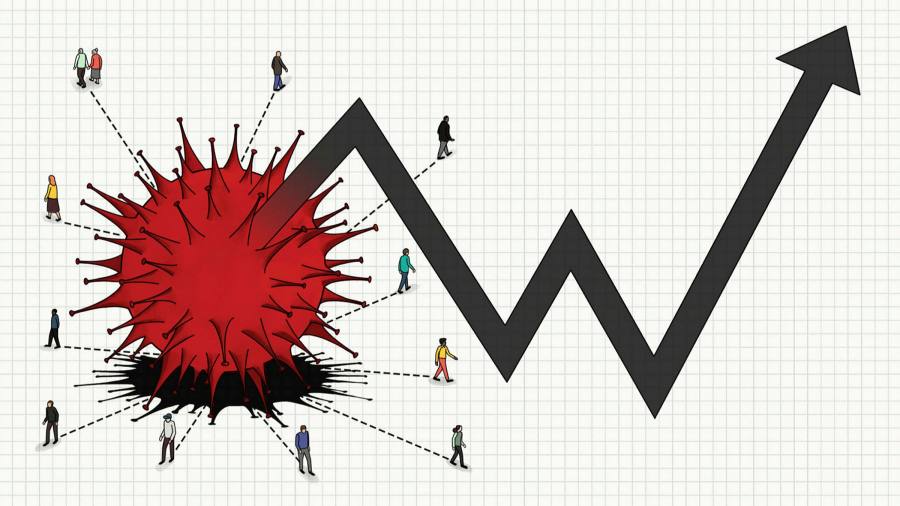

Inflation is Not a Fleeting Thing

#inflation #Fed #crypto #gold #silver "Inflation robs 'The People' in the subtlest…

Janet Yellen is Challenging Jerome Powell’s Control of the Financial Markets

#Fed #Treasury #inflation #employment #economy #money $DIA $SPY $QQQ $RUTX $USD $XAU…

The Case for $50oz Silver

#Silver $XAU $SLV $USD "Shortages of The Devil's Metal suggest that $50oz…

Hyperinflation is on Pace to Happen

#hyperinflation#subhyperinflation #gold #silver $XAU $GLD $XAG $SLV As "hyperinflation" begins to work…

Growing Inflation in Food and Fuel ‘Under the Radar’

#inflation #food #fuel #FFPI #Fed #money $XAU $XAG $GLD $SLV "The fast…

Demand for Gold, Silver Coins is Straining the US Mint’s Capacity

#USMint #gold #silver #coins $XAU $XAG The United States Mint said Tuesday…

Global Markets Rally, Gold and Silver Follow

#markets #rally #Gold #Silver $DIA $RUTX $SPY $QQQ $VXX $XAU $XAG $GLD…

Inflation Looms: Gold, Copper Spike, USD Falls, Big-caps Boom

#inflation #gold #silver #USD $DIA $SPY $QQQ $RUTX $XAU $GLD $XAG $CU…

We Cannot Control What Will Go On in a Democrat Controlled Washington, DC, but We Will Predict that Higher Taxes Will Bring on Rampant Inflation

#inflation #taxes #Democrat #Biden #economy $XAU $GLD $XAG $SLV $USD Joe Biden's…